Share prices have been falling across the FTSE 100 and FTSE 250 as worries over the global economy heat up. This in turn has supercharged interest from bargain hunters in a wide range of UK stocks.

These particular beaten-down blue-chip shares have attracted a lot of interest from AJ Bell investors over the past week. Here’s why I’d consider buying them for my own investment portfolio today.

Glencore

Commodities giant Glencore (LSE:GLEN) is the most popular of all shares traded on AJ Bell’s platform right now. It has commanded 12.3% of all buy orders during the past seven days.

It’s not difficult to see why it’s one of the UK’s most popular value shares. It trades on a forward price-to-earnings (P/E) ratio of 7.1 times. The firm also carries a huge 10.9% dividend yield.

Mining and trading businesses like these face trouble in the near term as global trade cools and raw materials demand declines. Indeed, latest export data from China today has set the sirens blaring again.

This showed outbound trade from the Asian powerhouse plummet by 7.5% in May. A far gentler 0.4% year-on-year decline had been anticipated.

But buying commodities companies like FTSE-quoted Glencore remains a good option for long-term investors. I myself expect the firm’s share price to soar from current levels as metal and energy demand balloons.

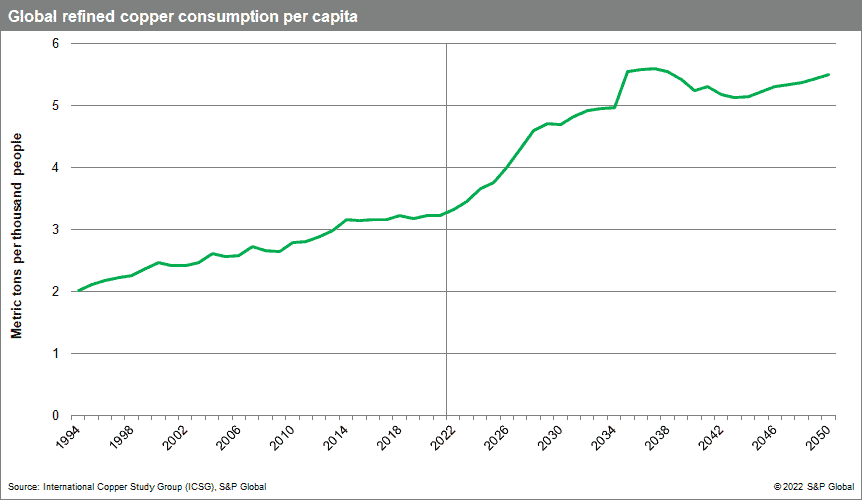

The chart above shows how copper consumption alone looks set to detonate over the next decade. Other commodities like aluminium, iron ore, nickel, and cobalt are also tipped to grow as the green transition takes off, and global spending on housing and infrastructure rises.

BAE Systems

Russia’s invasion of Ukraine means BAE Systems’ (LSE:BA) earnings picture looks more robust in the near term. In fact, global weapons spending just hit all-time peaks above $2.2trn (according to the Stockholm International Peace Research Institute).

This perhaps explains why AJ Bell investors are loading up on its shares. The FTSE 100 share accounts for 11.4% of all buy orders in the past week.

Western powers are pumping up their arms spending in response to Russian and Chinese foreign policy. The ongoing fight against terrorism is also commanding huge amounts of expenditure. And over the short-to-medium term at least these trends look set to keep going.

As a major arms supplier to UK and US governments, BAE Systems is on the front line of this demand boom. Indeed, strong interest from its traditional customers pushed the order intake to a record £37.1bn in 2022.

The business isn’t just reporting strong sales to Western clients, either. Purchases of its Typhoon aircraft from Gulf states Saudi Arabia and Qatar are also improving and expected to continue rising strongly.

BAE Systems’ products are highly complex. Project execution problems and disappointing results in the field are constant threats. And while these can affect future orders, the firm has an exceptional track record on this front. I think it’s a top buy for bargain hunters following recent share price falls.